Finding simple ways to manage your money is truly important, especially when internet access can be a bit tricky. So, when we talk about financial services, thinking about how people connect with their accounts without needing a fancy smartphone or a strong data signal is key. This is exactly where the idea of a USSD code for a platform like Palmpay comes into the picture, offering a pretty direct line to your funds.

Palmpay, you see, is a leading neobank and fintech platform, very much focused on making financial services available to more people. It works on driving financial inclusion and economic empowerment, especially in underserved emerging markets. This means reaching folks who might not have constant internet or the latest gadgets, which is a big deal for progress, you know?

Because of this focus, a USSD code becomes a really helpful tool. It allows people to perform various transactions and check account details using just a basic mobile phone, simply by dialing a short number sequence. This method is incredibly reliable and very widely accessible, making it a cornerstone for expanding financial services to a broader audience, which is something Palmpay aims for, apparently.

- Taylor Nicole Dean Age

- Height Of Betty White

- Medieval Last Names For Royals

- How Old Is Candy Aguilar

- Nerdy Cartoon Characters With Glasses

Table of Contents

- What is USSD and Why Does Palmpay Use It?

- How Palmpay's USSD Code Works

- The Benefits of Using Palmpay USSD

- Tips for a Smooth Palmpay USSD Experience

- Frequently Asked Questions About Palmpay USSD

- Bringing It All Together

What is USSD and Why Does Palmpay Use It?

USSD, which stands for Unstructured Supplementary Service Data, is a type of communication protocol used by GSM mobile phones to communicate with the service provider's computers. It's a bit like sending a quick message back and forth, but it's not SMS. Instead, it creates a real-time connection during a session. This means you get an immediate response, which is very helpful for things like checking your bank balance or sending money, you know?

For a company like Palmpay, which is working to bring financial services to places where traditional banking might be hard to get, USSD is a game-changer, in a way. It allows them to serve a much broader group of people who may not have access to the internet or even a smartphone. This method truly supports their goal of financial inclusion, as a matter of fact.

Bridging the Digital Divide

In many emerging markets, a lot of people still use feature phones, or perhaps they have smartphones but reliable internet data can be quite expensive or simply unavailable. USSD bridges this gap, allowing these individuals to access essential financial services without needing to be online. This capability is absolutely vital for economic growth in these areas, you see.

Palmpay's mission to empower people financially really relies on methods that are broadly available. So, using USSD means they can reach customers in remote villages or urban areas with poor connectivity, making financial tools accessible to pretty much anyone with a mobile phone. It's about ensuring no one is left behind, which is a good thing, really.

Simplicity and Reach

The beauty of USSD lies in its simplicity. There is no need to download an app, remember complex passwords for online logins, or even have a data plan. Users simply dial a short code, and a menu appears on their phone screen, guiding them through various options. This straightforward approach makes it very easy for anyone to use, regardless of their tech savviness, I mean.

Its wide reach is also a huge advantage. USSD works on all GSM networks and virtually every mobile phone, from the most basic models to the latest smartphones. This universal compatibility means Palmpay can serve a massive potential user base, making financial services a reality for millions who might otherwise be excluded, you know?

How Palmpay's USSD Code Works

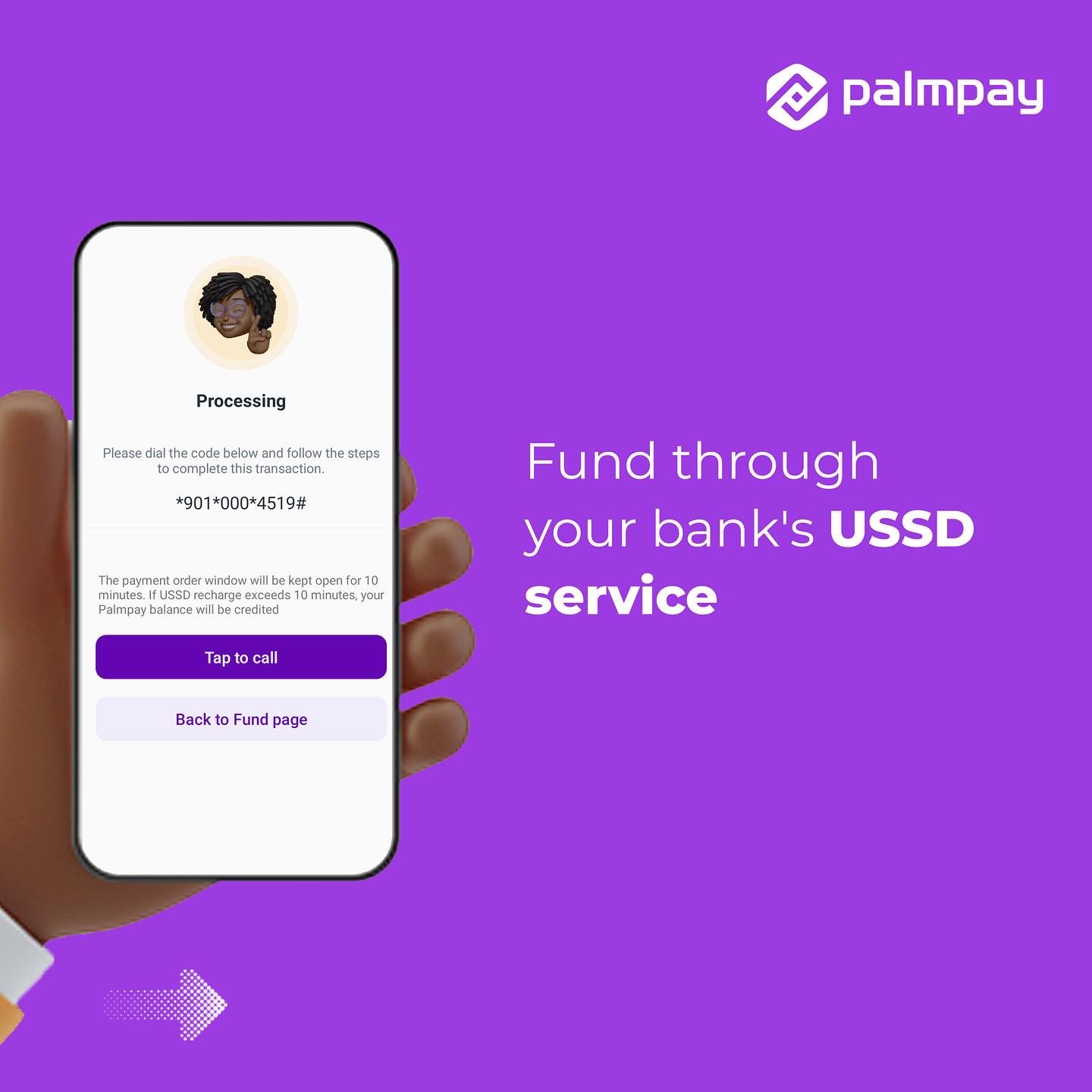

While I can't provide the exact Palmpay USSD code here, as those can change and depend on your region or specific service, the general way a USSD code works for a financial platform is pretty standard. Users dial a specific short code, usually starting with an asterisk (*) and ending with a hash (#), followed by a series of numbers. For instance, it might look something like *XXX# or *XXX*YYY#. After dialing, a text-based menu pops up on the phone's screen, offering a list of services.

You then respond by entering numbers corresponding to your desired action, like '1' for balance inquiry or '2' for money transfer. This interaction continues until your transaction is complete or you exit the session. It's a surprisingly quick and effective way to get things done, even if it feels a little old-school, you know?

Common USSD Actions

A financial platform like Palmpay, which focuses on daily transactions, would typically offer a range of services through its USSD code. These might include checking your account balance, transferring money to another Palmpay user or even to another bank account, paying bills, buying airtime or data, or perhaps checking transaction history. These are the kinds of things people need to do often, actually.

The exact options available would depend on what Palmpay has set up for its users in a given area. But the core idea is to provide the most frequently used financial services right at your fingertips, literally, through your phone's dial pad. This convenience is a big part of why USSD remains so relevant, you see.

Getting Started with USSD

To begin using Palmpay's USSD services, you would typically need to have an active Palmpay account. The first step usually involves dialing the specific USSD code provided by Palmpay. Upon dialing, you might be prompted to register for the USSD service if it's your first time, perhaps by setting up a personal identification number (PIN) for security. This PIN is really important for keeping your transactions safe, obviously.

Once registered, you can then proceed with your desired transaction by following the on-screen prompts. It's a pretty straightforward process that usually takes just a few moments to get the hang of, and it's quite intuitive, more or less. Always make sure you're dialing the correct and official Palmpay USSD code to avoid any issues, by the way.

The Benefits of Using Palmpay USSD

The advantages of using a USSD code for a financial service like Palmpay are quite numerous, especially when considering the diverse needs of its user base. It's not just about convenience; it's about making financial services truly democratic and widely available. This approach really helps Palmpay achieve its broader mission, you know?

One of the biggest benefits is the sheer reliability of USSD. It works even in areas with very poor network coverage where internet-based apps would simply fail. This makes it a lifeline for many, ensuring they can always access their money and perform transactions when they need to, which is a big comfort, apparently.

Accessibility for Everyone

As mentioned, USSD doesn't require a smartphone or an internet connection. This means that anyone with a basic mobile phone can use Palmpay's services. This broad accessibility is a cornerstone of financial inclusion, allowing people from all walks of life, regardless of their technological resources, to participate in the digital economy. It's a very inclusive approach, actually.

This capability helps empower individuals who might otherwise be excluded from formal financial systems. They can send money to family, pay for goods, or save funds securely, all from the device they already own and know how to use. This kind of access can genuinely change lives, you see.

Speedy Transactions

Because USSD sessions are real-time and don't rely on data packets, transactions are often very fast. You dial the code, follow a few prompts, and the transaction is usually processed almost instantly. This speed is incredibly valuable for urgent transfers or payments, especially when time is of the essence, you know?

Unlike app-based transactions that might lag due to slow internet, USSD provides a consistently quick experience. This reliability in speed means users can count on their transactions going through without frustrating delays, which is a major plus for daily financial activities, pretty much.

Security Considerations

When using USSD for financial transactions, security is always a top concern, and rightly so. Palmpay, like other reputable financial platforms, would employ various security measures to protect user data and funds. This typically includes requiring a personal PIN for every transaction, ensuring that only the account holder can authorize actions. This PIN is your first line of defense, so keep it safe, okay?

It's also important for users to be aware of their surroundings when entering sensitive information and to never share their PIN with anyone. While USSD itself is a secure protocol, user vigilance is still a key part of maintaining financial safety. Always double-check the transaction details before confirming, by the way.

Tips for a Smooth Palmpay USSD Experience

To make the most of your Palmpay USSD interactions, there are a few simple tips that can help ensure a smooth and trouble-free experience. These suggestions are generally good practice for any USSD-based financial service, so they're worth keeping in mind. It's about being prepared, you know?

Know Your Code: Always have the correct Palmpay USSD code handy. You can usually find this on Palmpay's official website or by contacting their customer support. Writing it down somewhere safe might be a good idea, actually.

Keep Your PIN Secret: Your transaction PIN is like the key to your money. Never share it with anyone, not even Palmpay staff. If someone asks for it, it's a red flag, seriously.

Confirm Before You Send: Before finalizing any transaction, especially money transfers, always double-check the recipient's details and the amount. A small mistake can be hard to fix later, obviously.

Stay Updated: Occasionally, USSD codes or services might be updated. It's a good idea to check Palmpay's announcements or website for any changes, just to be sure you're using the latest information, in a way.

Be Mindful of Timeouts: USSD sessions can sometimes time out if you take too long to respond. If this happens, simply redial the code and start again. It's a minor inconvenience, but good to be aware of, you know?

Use a Reliable Network: While USSD works even with weak signals, a more stable network connection will always provide a better and faster experience. This is especially true if you're in a remote area, pretty much.

These tips are pretty basic, but following them can save you a lot of hassle and ensure your financial transactions are handled efficiently and securely. It's about being smart with your money, after all.

Frequently Asked Questions About Palmpay USSD

What is a USSD code for Palmpay?

A USSD code for Palmpay is a special short number you dial on your mobile phone to access various financial services without needing internet data or a smartphone app. It allows for real-time interaction with your Palmpay account, letting you do things like check your balance or send money, more or less. It's designed for simple, quick access, you know?

How does Palmpay USSD help people without internet?

Palmpay USSD helps people without internet by providing a way to perform financial transactions using only their mobile network signal. Since it doesn't require data or a smartphone, it makes financial services available to individuals who might have basic feature phones or limited access to the internet, truly expanding financial inclusion, you see. It's a lifeline for many, actually.

Can I do all Palmpay transactions using USSD?

While USSD codes offer a wide range of common financial transactions, like checking balances, transferring money, and paying bills, it's possible that some more complex or less frequent services might still require the Palmpay app or online platform. The exact range of services available via USSD depends on Palmpay's offerings in your specific region, so it's good to check with them directly, by the way. It typically covers most daily needs, though, pretty much.

Bringing It All Together

The Palmpay USSD code, or the idea of it, really stands as a powerful tool for financial inclusion, especially in places where digital access isn't always a given. It shows Palmpay's commitment to reaching everyone, offering a simple, reliable, and widely accessible way to manage money. This method helps people take control of their finances, which is very important for their well-being, you know?

By making essential financial services available through a basic phone, Palmpay helps bridge gaps and empower communities. It’s a testament to how technology, even simple forms of it, can create significant positive change in people’s lives. To explore more about how Palmpay is making a difference in financial access, you can learn more about USSD technology and its broader impact. You can also learn more about Palmpay's mission on our site, and link to this page for specific services offered. It's worth looking into, honestly.

- Cute Names For A Fox

- Chamath Palihapitiya Wife

- Jedediah Bila Husband

- Surgery Prayer Quotes

- William S Chappelle

Detail Author:

- Name : Gracie Trantow

- Username : qconsidine

- Email : gerhold.nicholaus@orn.net

- Birthdate : 2006-05-02

- Address : 1742 Chase Station New Maria, ME 71058-1863

- Phone : +1.469.338.2382

- Company : Hintz-Frami

- Job : Credit Authorizer

- Bio : Tenetur et accusantium est architecto est. Veniam libero numquam velit saepe. Dolor voluptate soluta repellat ea. Officia optio et quas repellat quod numquam.

Socials

instagram:

- url : https://instagram.com/chanel.sipes

- username : chanel.sipes

- bio : Voluptates quia ut labore qui. Tempore est quam neque dicta. Qui consequatur dicta et ab.

- followers : 1139

- following : 512

twitter:

- url : https://twitter.com/chanel9192

- username : chanel9192

- bio : Optio eos cumque molestiae aliquam aliquam suscipit voluptatibus. Provident consequatur ut expedita qui.

- followers : 3680

- following : 2773

linkedin:

- url : https://linkedin.com/in/chanel.sipes

- username : chanel.sipes

- bio : Aut libero eos in ullam molestias.

- followers : 1352

- following : 1110